Francine worked for more than 10 years as a nurse in Sherbrooke before she was diagnosed with fibromyalgia. Her primary income now is from Canada Pension Plan – Disability (about $1,127 per month). She was surprised when she qualified for the Disability Tax Credit, but is excited because it provides an effective way for her to continue to save for her retirement years.

Francine worked for more than 10 years as a nurse in Sherbrooke before she was diagnosed with fibromyalgia. Her primary income now is from Canada Pension Plan – Disability (about $1,127 per month). She was surprised when she qualified for the Disability Tax Credit, but is excited because it provides an effective way for her to continue to save for her retirement years.

Francine opened her RDSP in 2008. She is the Holder of her RDSP. She has been contributing $1,500 a year – from the RRSP which she had set up when she was a nurse. She plans to contribute $1,500 every year until she is 49 (2025), for as long as she can get the federal government Grant and Bond. This way she gets the maximum Canada Disability Savings Grant. She also gets the maximum Canada Disability Savings Bond because her net taxable income is less than $23,855.

Her contributions will look like this:

| Year | Personal Contributions | Federal Government Contributions | Total Contributions |

| 2008 | $1,500 | $4,500 | $6,000 |

| 2009 | $1,500 | $4,500 | $6,000 |

| 2010 | $1,500 | $4,500 | $6,000 |

| 2011 – 2025 | $22,500 | $67,500 | $90,000 |

| Total | $27,000 | $81,000 | $108,000 |

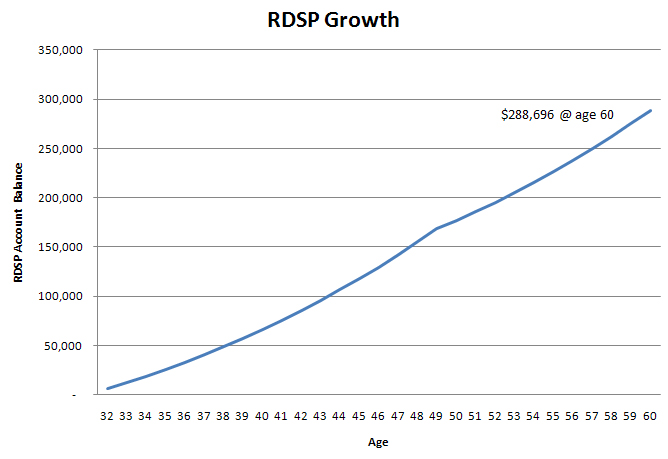

With a modest return on her investments (5% annually) her RDSP will grow as follows:

When she is 60 her RDSP will provide her with approximately $12,500 per year. As she doesn’t plan to contribute more than the federal government, her payments will be limited by the LDAP formula. If she wanted more flexibility, she would need to deposit an additional $54,001 to her RDSP so that private contributions exceed the federal government contributions of $81,000.

Click here to Contact Us and get started on your own RDSP today!

Get started on your Application now!

Get started on your Application now!