Marie is a bubbly six year old, who loves her dog, Bud, and her little sister, Bella (in that order) and who has Down Syndrome. They live in Toronto with their mother, Rosa. Rosa is a part-time nurse, whose income is below $81,941. Marie’s grandparents are a big part of her life and contribute $1,500 per year into her RDSP.

Marie is a bubbly six year old, who loves her dog, Bud, and her little sister, Bella (in that order) and who has Down Syndrome. They live in Toronto with their mother, Rosa. Rosa is a part-time nurse, whose income is below $81,941. Marie’s grandparents are a big part of her life and contribute $1,500 per year into her RDSP.

Rosa opened Marie’s RDSP in 2008, just after Marie’s fourth birthday. She applied for the DTC and was granted at DTC certificate for Marie for life. Marie’s mother currently claims the DTC and the under 18 supplement (worth $1,451 and $846 respectively). She will still be able to claim the DTC once Marie is an adult if she is financially dependent and/or she continues to play a role in caring for her. She also claims that Canada Child Tax Benefit (CCTB), which is the mechanism with which HRSDC determines the “net family income” for families of minor children.

Rosa is the Holder of Marie’s RDSP and she plans to continue after Marie is an adult as Marie will likely be unable to manage her own finances. She does, however, need a backup plan in the event that anything happens to her. While Marie is a child, only her parents or guardians (including the Public Guardian and Trustee) are authorized to act as holder. She can appoint a guardian in her Will in the event that she passes away while Marie is a minor. Once Marie is an adult, she can no longer do this. Under the current laws, someone would need to apply for a guardianship order to manage Marie’s RDSP if her mother passes away while she is an adult.

Rosa had told her parents about the new savings plan and that she didn’t think that she could afford to make contributions. Rosa’s parents immediately saw the benefit and told her that they would be honoured to contribute to Marie’s future financial security. So far, they’ve made three contributions of $1,500. And they’re planning to continue. They’ve made a provision in their Will so that if anything happens to them, a trust will be established to continue the payments to the RDSP.

The federal government has contributed $10,500 through the Canada Disability Savings Grant program. At the end of December, 2011 Marie had a bit more than $15,000 in her RDSP.

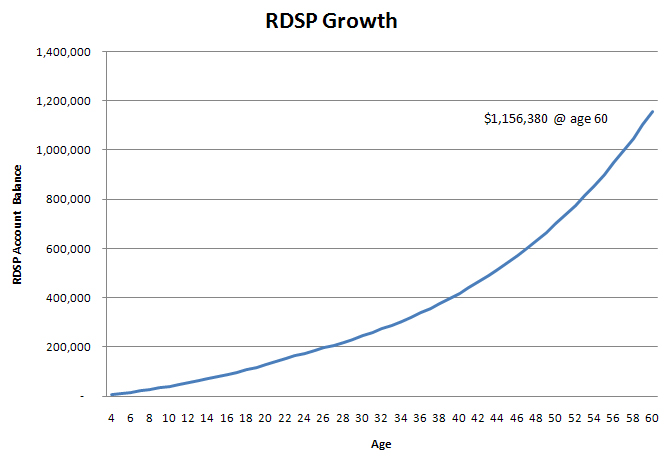

The following graph shows how her RDSP will grow until Marie is 60 years old. (We’ve assumed that her RDSP will have moderate investment returns of 5%.)

Rosa expects that Marie will start using her RDSP when she is about 35. At that age, 10 years will have passed since she received the last federal government contributions so that holdback amount will be zero.

At 35 she can take a one-time Disability Assistance Payment or she can begin Lifetime Disability Assistance Payments, but either will be limited in size by the LDAP formula until private contributions are greater than the federal government contributions of $90,000.

If her grandparents have passed away and left more than $60,000 for her RDSP then private contributions will exceed federal government contributions. This removes the limitations of the LDAP formula. Another option would be to borrow, $60,001 just before she begins to start withdrawals and deposit it in her RDSP.

If she waits until she is 60, the RDSP will provide payments of approximately $4,200/month.

Read about: Marshall’s RDSP

Get started on your Application now!

Get started on your Application now!