Marshall is a typical 15 year old from Glace Bay – he worships Sidney Crosby. Unfortunately, his mental health concerns have become more and more evident in the past number of years. Worried about his future, his parents, Harold and Bea, opened an RDSP for Marshall as soon as they heard about it in 2008.

Marshall is a typical 15 year old from Glace Bay – he worships Sidney Crosby. Unfortunately, his mental health concerns have become more and more evident in the past number of years. Worried about his future, his parents, Harold and Bea, opened an RDSP for Marshall as soon as they heard about it in 2008.

Marshall’s DTC has only been granted until adulthood – age 18 under federal laws. At that point he will need to reapply. Marshall’s parents claim the DTC and Under 18 Supplement (worth $1,515 and $928 respectively in 2010). While Marshall is a minor, his parents must also claim the Canada Child Tax Benefit (CCTB), whether they receive a benefit from it or not.

Bea will be the holder of Marshall’s RDSP while he is a minor. She plans to continue in this role once he is an adult as they are concerned about how his illness sometimes makes him irresponsible with money. They will need to make a plan for their death’s, however, as Marshall would become the holder on her death, if he is an adult. Like many parents of children with mental health issues, Harold and Bea are concerned about the possible misuse of the funds in Marshall’s hands.

Harold and Bea’s net combined family income is less than $81,941, so the federal government contributes $3 for every $1 that they contribute on the first $500 and $2 for every $1 that they contribute on the next $1000. This means that if they contribute $1,500, the federal government contributes $3,500. That’s an immediate return of 233% without any risks. It’s too good for them to pass up.

Marshall’s parents have an automatic deposit plan set up with their bank. $125 per month is automatically withdrawn from their account and directly deposited into Marshall’s RDSP. They are the holders of the RDSP now (they make investment and other decisions) and they plan to continue as holders until they are absolutely sure that Marshall is able to make good financial decisions.

Earlier this year, Marshall’s grandma passed away. She left $25,000 to each of her grandchildren. Harold and Bea plan to put Marshall’s portion directly into his RDSP. So by the end of 2011, contributions to Marshall’s RDSP will look like this:

| Year | Family Contributions | Federal Government Contributions | Total Contributions |

| 2008 | $1,500 | $3,500 | $5,000 |

| 2009 | $1,500 | $3,500 | $5,000 |

| 2010 | $1,500 | $3,500 | $5,000 |

| 2011 | $26,500 | $3,500 | $30,000 |

| Total | $31,000 | $14,000 | $45,000 |

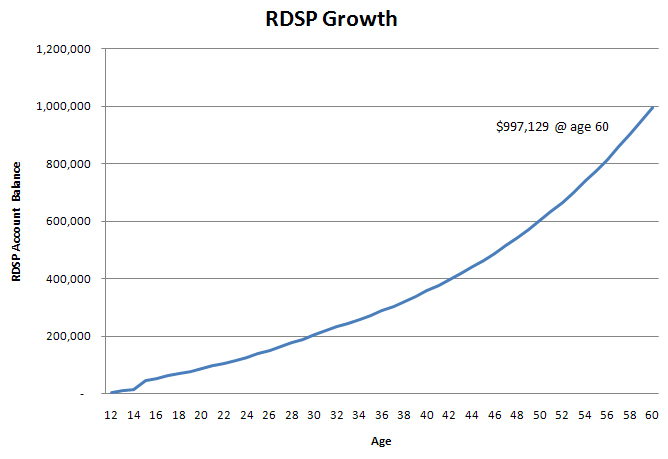

Here’s how Marshall’s RDSP will grow until he is 60. (We’ve assumed that his RDSP will have moderate investment returns of 5%.)

When Marshall is 60, he will have $997,129 in his RDSP and it will provide him with an RDSP income of approximately $43,000 per year.

Marshall’s RDSP was opened when he was 13. Federal contributions will be maximized at age 32 and therefore, he will be able to receive payments from his RDSP at age 42 without any penalties. Unless private contributions exceed his payments, one time or LDAP will be limited by the LDAP formula. In a situation where his parents are concerned about mis-use, this provides some limitations on spending, however, it also reduces flexibility.

Read about: Sandeep’s RDSP

Get started on your Application now!

Get started on your Application now!