Sandeep is an easy-going 22 year old who loves wrestling (WWE), the Vancouver Canucks, work and girls. Sandeep’s diagnosis isn’t clear but he struggles with keeping his life on track (taking his medications, managing his money, getting to work on time, eating well, and making good decisions). His income is below $23,855 and he isn’t able to make any contributions to an RDSP right now.

Sandeep is an easy-going 22 year old who loves wrestling (WWE), the Vancouver Canucks, work and girls. Sandeep’s diagnosis isn’t clear but he struggles with keeping his life on track (taking his medications, managing his money, getting to work on time, eating well, and making good decisions). His income is below $23,855 and he isn’t able to make any contributions to an RDSP right now.

Sandeep’s brother, who is a financial planner with BMO, told him about the RDSP when BMO first began to offer it the savings plan 2008. Sandeep didn’t think it was for him because he really didn’t have any extra money at the end of every month. His brother reassured him that he could open an RDSP if he qualified for the Disability Tax Credit and that the federal government would make contributions even if he couldn’t – as long as he continued to file his income tax returns.

Sandeep doesn’t live with his parents but it’s hard to imagine him living independently without their support. As a result, he was able to transfer his credits to them. They received a refund of more than $15,000 as they were able to adjust their taxes for the past 10 years. The family discussed what to do with the refund and they agreed that they would use $10,000 of it to get Sandeep’s RDSP started.

Sandeep is the Holder of his RDSP. His family assists him in making financial decisions. If he wanted his brother or another family member to manage his RDSP for him, he could do a Representation Agreement (under the Representation Agreement Act). This is specific to BC and not available in other provinces.

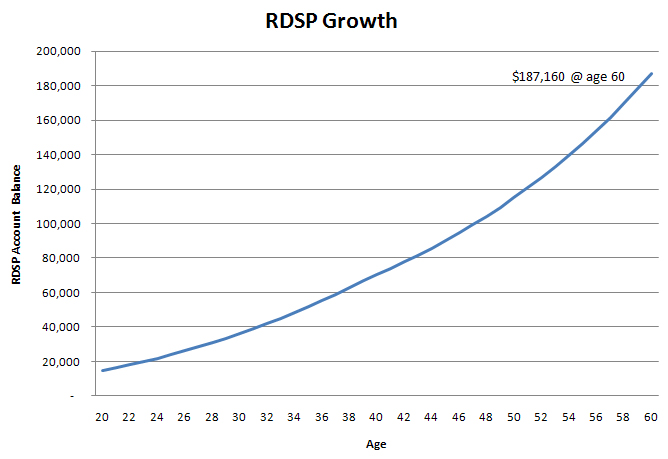

Sandeep opened his RDSP at the end of 2009 with $10,000. In 2009 and 2010 he qualified for the Canada Disability Savings Bond – his income was below $23,855. His RDSP now has about $18,000 in it. We estimate that his RDSP will grow as per the following graph and will be worth $187,160 when he is 60. (We’ve assumed that his RDSP will have moderate investment returns of 5%.)

If Sandeep retires when he is 60, he could receive approximately $8,100 per year from his RDSP for the rest of his life.

Because Sandeep opened his RDSP when he was 21 and he only plans to receive the Canada Disability Savings Bond, he will likely have maximized the Bond contributions at age 40 so he will be able to receive withdrawals – one time or Lifetime Disability Assistance Payments – at age 50 without any federal penalties. At that age, the holdback amount should be $0.

Read about: Francine’s RDSP

Get started on your Application now!

Get started on your Application now!